What is a product group?

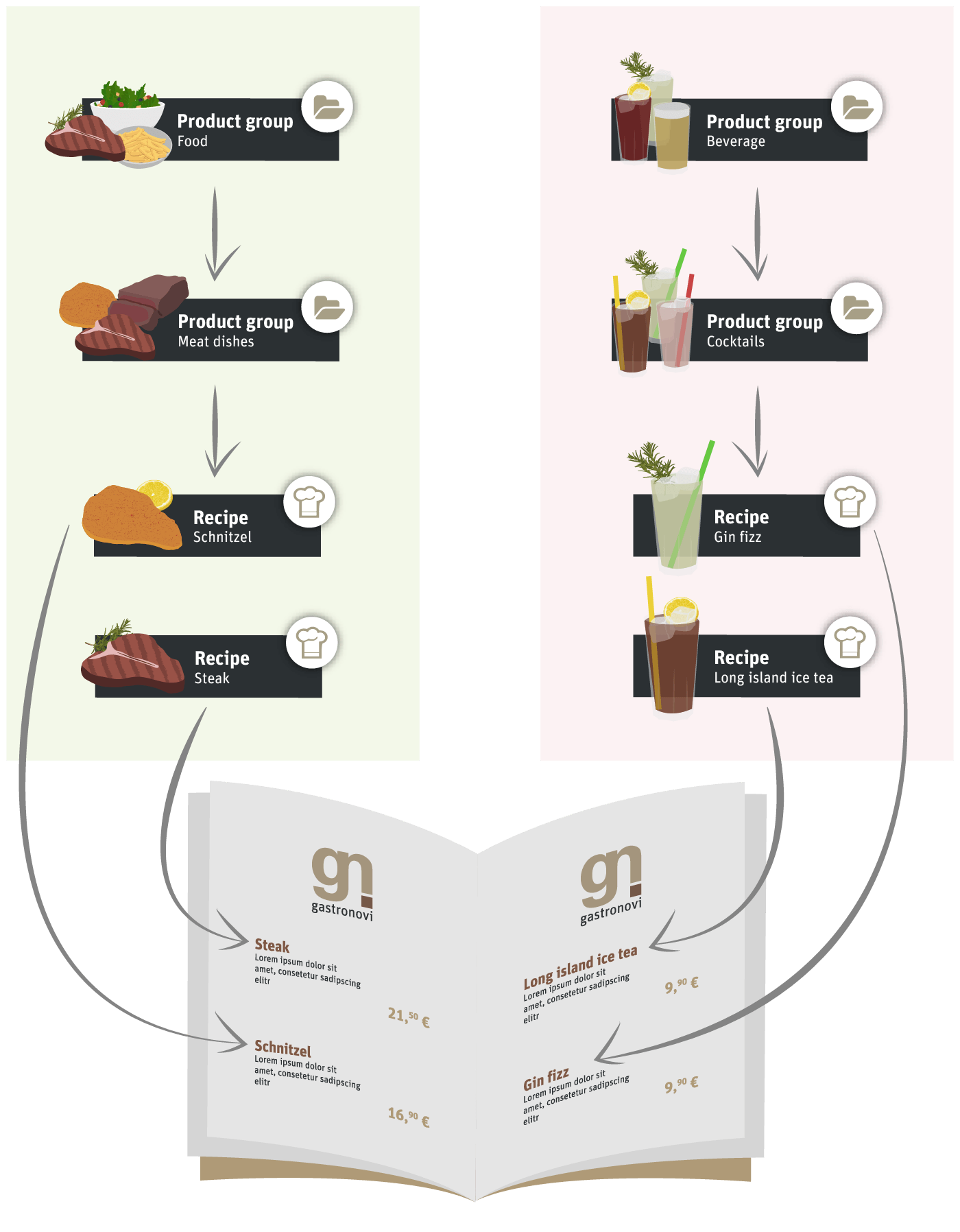

Product groups are used to structure your recipe collection. Each recipe is assigned to a suitable product group, allowing you to clearly analyze your turnover and sales figures. For example, generate a product group for your non-alcoholic drinks, create a clear structure for your wines or differentiate between hot and cold dishes.

To summarize: A sophisticated and well thought-out product group structure makes your system clearer and gives you more setting options, adjustments and evaluation options in the statistics. Both the configuration of production vouchers and the assignment of the VAT rates to be used are controlled via product groups. Rates to be used is controlled via product groups.

In Gastronovi Office, we divide into four main product groups:

- Food (meals)

- Beverage (drinks)

- Non-Foods (non-food)

- Unsorted product groups

These main product groups cannot be removed or changed. Instead, you can create a flexible structure with sub-groups. For example, soups and salads in the Food area, cocktails and beers in the Beverage area or vouchers and decoration in the Non-Foods area. Recipes are collected in the fourth merchandise group, Unsorted merchandise groups, if sub-merchandise groups are removed. Imported recipes also end up there first before you can assign them further.